Do we need a trustless legal system?

“Trust dies but mistrust blossoms…” - Sophocles

It is no secret that access to justice does not come equally. In fact, discussions on this topic are far and wide, taking place more than ever.

Recently, at the annual Innovations in Technology conference, Jim Sandman, the president of the Legal Services Corporation, has put it quite directly:

“The system is failing. Failing. We just need to acknowledge that.”

In times when everything around us seems to be scaling at a mind-boggling speed, we seem to remain stuck with legal institutions straight out of the 19th century.

Is there any solution? Let’s rewind a bit...

About a year ago...

Ripple, the Silicon Valley FinTech company, has introduced the University Blockchain Research Initiative (UBRI). They deploy funds to University projects aiming to determine the role of Blockchain in the future and (hopefully) better society.

“Part of what Ripple’s looking at is can blockchain add a value layer to that, so the Internet of Data matches with the Internet of Value.”

At the time, Scott Chamberlain, Senior Lecturer at the Australian National University (ANU), received funding from UBRI. Scott’s goal - to research the legal implications of blockchain and smart contracts on civilization as a whole.

“The Australian National University has become the first in the country to secure funding from UBRI to research and create courses around the legal implications for the law profession and governments from the emerging technologies of blockchain, smart contracts, and digital payments.”

Scott was very kind to share his vision of the future of law and society with blockchain.

Below, he discusses how to scale the scales of Justice; can we do without a central governing authority; how blockchain and smart contracts can remove legal system bottlenecks; what should lawyers know about emerging technologies; as well as his vision of the glorious new world.

Let’s get right into it:-

How Legal Tech changed legal services delivery

Q: For starters, what will the research be about? Any particular objectives? Why did you decide to focus on the field of blockchain?

Scott Chamberlain: Once upon a time all lawyers did all legal work in the same way. Technology has changed that. It is now apparent that there are different scales of legal work.

Law as a Project, Process, Person, and Program

For starters, there’s “Law as a Project” where the work requires large teams of experts, support staff, and office resources. This is the work large law firms like to do.

Further, there is “Law as a Process” where the work requires large support staff and office resources, but few experts since their expertise remain in standardized systems. This is the work legal process outsourcers like to do.

Also, there is “Law as a Person” where the work requires a smart person with a laptop and an internet connection. This is the work barristers and ADR experts have traditionally done. Likewise, it is now a burgeoning field of people-placement and lawyer-for-hire business models.

Finally, there’s “Law as a Program”, where the work can be automated through the sufficient application of 1’s and 0s and $s.

But scales of justice haven’t scaled

Underpinning these is the “platform” on which it all runs. The current justice delivery platform is a combination of text-based laws, contracts and legal documents being drafted, interpreted, litigated and determined by real people in physical offices and courts.

This has been invisible until now but is coming to light as slow, costly and uncertain. While commerce increasingly benefits from automation, it grinds to a halt when it hits our 19th-century justice delivery system.

The scales of justice have not scaled.

“We need a different Justice Delivery Platform. I think that platform involves blockchain, digital assets, smart contracts, AI and AR…”

Hence, “Law as a Platform” is the focus of my work.

eBay as a global dispute resolution platform

I’ve found the best explanation of what I am working on is by way of example. And the best proto-example is eBay.

eBay provides a global platform for buying and selling low-value goods. It has consistent terms and conditions for buyers and sellers. It is underpinned by an automated dispute resolution service that dealt with over 60 million disputes in 2014.

No traditional court system comes close.

Moreover, a sliver of insurance protects users against fraud. This is a holistic package that scales the trust necessary for users to embrace and enjoy other benefits of the platform.

Without the rapid, low-cost dispute resolution service, in particular, the entire thing might fail. Imagine if users had to rely on traditional courts for eBay disputes.

Can we do without a central coordinating entity?

My question is: why can’t the government do this? Or, why can’t we do this without the government and without a coordinating centralized organization?

Why can’t we do away with large slabs of consumer law and instead have a decentralized platform for buying consumer goods? One that works on consistent terms and conditions, with a rapid, low-cost dispute resolution system, and a sliver of insurance against fraud?

All of that seems possible given the tech-stack of blockchain, smart contracts, digital payments, and AI.

(maybe I’m wrong, but that is why what I am doing is research and not commercialization)

How Blockchain will impact society as a whole

Q: What would be, in your view, some of the implications of the above tech to legal/regulatory/justice fields?

SC: Clients don’t want to be projects. That is, nobody wants their legal rights and obligations to involve large teams of lawyers and support staff doing long hours in large offices. And the truth is lawyers don’t usually like this type of “industrialized” work.

If we can automate stuff, then clients get affordable enforcement of rights and obligations, lawyers get to advise and strategize as wise advisors, and the government has to spend fewer taxpayer dollars on ensuring taxpayers' rights and obligations are enforced.

Are smart contracts a part of the solution?

Q: Lots of talk about smart contracts in the past years. How do you see those used in the future? Any relevance for law / lawyers / law students?

SC: I see smart contracts as part of a solution, not a solution in themselves. They provide automated execution of defined rights and obligations. But I think they work best as part of a platform, part of a suite, tailored to the relationship or transaction they are automating.

In that vision, they become an invisible part of a transaction or relationship. A trust-minimized way of ensuring rights and obligations are enforced means less regulation overall.

What role could lawyers play with smart contracts?

Q: Smart contracts may not be written by lawyers. But would they need to be supervised/approved by lawyers?

SC: I think smart contracts are going to need some kind of quality assurance. Otherwise, they won’t be broadly trusted.

That will probably mean lawyers working in tandem with programmers to confirm the code produces legally compliant outcomes. Claiming the template has been reviewed/drafted/certified by lawyers, and even naming the firm or legal body, will be standard.

I’m thinking, by analogy, of the many agreement templates or precedents industry associations publish to assist their members. Or the many online document marketplaces that have sprung up.

Q: Do you think lawyers should know more about smart contracts?

SC: Yes and no. The law is not monolithic anymore. Just as there are different scales there are also different *types* of legal work:

- Advisory, where you deal only with the client;

- Transactional, where you help a client through a voluntary transaction;

- Litigious, where you help a client through a civil dispute; and

- Prosecutorial, where one party to the dispute is the state in its enforcement capacity.

Technology differently impacts each of these types. Namely, it will be quite possible for a lawyer to continue to successfully practice in criminal law without knowing anything about how to program smart contracts.

Transactional lawyers, however, as well as those interested in legal policy and law reform, should certainly have a working, or even deep, knowledge of emerging tech.

The Internet exploded interactions, but it didn’t facilitate trust

Q: You once said, “The internet has exploded the number of interactions and information we can share with other people, but it didn’t explode trust”. What did you mean by that?

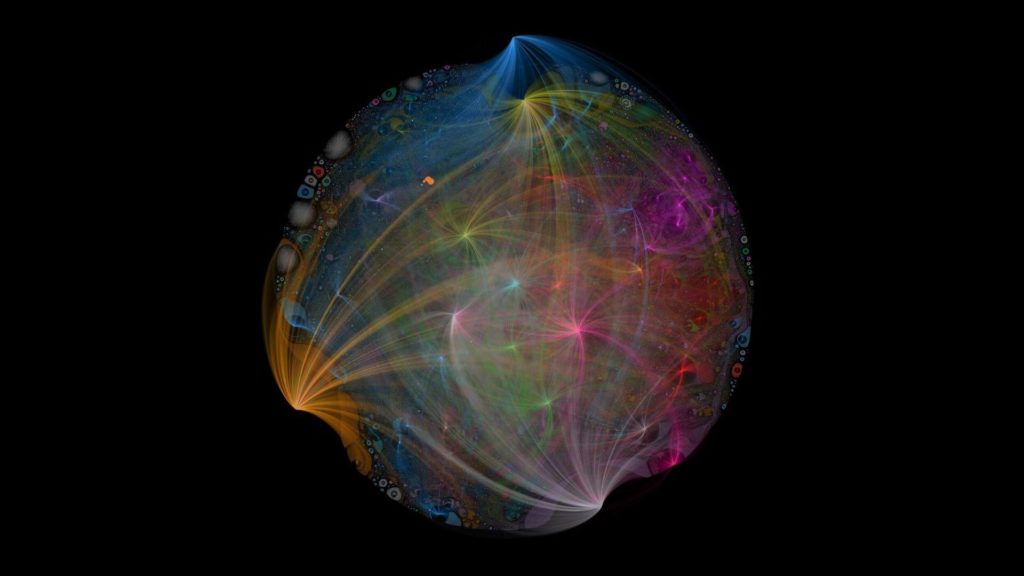

SC: Sure. Societies work through social scaling, allowing humans to trust and collaborate outside kin and clan, and across time and space.

One part of this is information sharing and matchmaking, so people can make valuable transactions, and one part of it is trust minimization, so parties can rely on the deals done without needing to know the other parties.

Money, customs, religions, courts, police, and bureaucracies are all institutions we use to make social scaling possible.

The internet exploded our capacity to share information and match-make. We can do deals with anyone on the planet. But we cannot rely on those deals to the same extent.

Fake news, identity theft, and copyright theft are all examples of how hard it is for you to trust the information you receive. Our traditional institutions are groaning under the weight of supplying that trust.

For example, content producers struggle to protect and enforce their copyright. They must rely on ever-more draconian tactics and laws. This is because the information is shared untethered from the legal right to access it. You cannot trust that someone has the right to view a movie just because they possess a copy of it.

In a better world...

...the right to watch the movie – and the capacity for the artist to receive a proper compensation - would travel with a copy of the movie itself.

I’m interested in exploring if this is a possible outcome.

The implication – as with any project – would be that huge slabs of legal regulation could go away. A reliable technology platform, one that fuses copies with rights and payments, could provide trust (rather than people who interpret and enforce those legal provisions).

“Part of what Ripple’s looking at is can blockchain add a value layer to that, so the Internet of Data matches with the Internet of Value.”

“For the legal profession, that promises a bunch of potential solutions to an enormous number of problems that people experience.”

“Mr. Chamberlain and his research partners, starting with software developers, will study whether emerging financial technologies can help.”

On the road to scale justice...

Q: What does your roadmap look like? What aspects do you want to research first?

SC: In general, I’m looking into projects that deliver a justice dividend – a sustainable improvement in the capacity for a large number of citizens or clients to protect their rights or meet their obligations.

I’m interested in scaling justice, which means greater access to justice for the “meat of the bell curve”.

Namely, those are individuals and small businesses for whom the current systems are too complex, slow, expensive and risky, but who cannot qualify for the legal aid and other “access to justice” programs typically afforded some minority groups.

“Booking your Uber is so fantastically seamless and easy, and yet enforcing your legal rights is so difficult and complex...”

“I’m looking at what I call the ‘Lex Automagica Tech Stack’ – blockchain, plus digital assets, plus smart contracts, plus AI (Artificial Intelligence), plus AR and VR (Augmented Reality and Virtual Reality..."

"Lex Automagica could power our societies like clockwork...”

XRP Ledger transactions visualized in November 2018 by Thomas Silkjaer

Lex Automagica to scale civilization

Q: Would you please tell us more about the Lex Automagica Tech Stack?

SC: Think of eBay (fair and consistent terms and conditions, rapid and costless dispute resolution, and insurance against fraud), but without eBay in the middle.

Now apply that to… almost anything.

Q: Are blockchain, digital assets, and smart contracts a part of the Lex Automagica?

SC: I think all of these are part of a “Justice Delivery Platform 2.0”. The current system just doesn’t scale.

There are not enough lawyers and legal aid dollars to make the world go around the way that it should without some kind of underlying automation layer.

“There’s a whole lot of things that need research, it’s not just blockchain but legal tech in general. The whole space is a Cambrian explosion of new and wonderful things to sink your teeth into.”

Legal Tech and blockchain - in B2B or in B2C at first?

Q: Legal Tech “vertical” is wide enough to represent a horizontal in its own right. What do you think blockchain / Digital Assets / Smart contracts would penetrate first - B2B products (e.g. legal practice management and/or billing solutions) or B2C (e.g. access to justice enablers)?

SC: You need to penetrate where there is a need and a market, but no regulatory barriers.

You would think it would begin with law firms adopting tech internally to better assist their lawyers to service their clients. But their business models often prohibit this.

It is very difficult for a firm that makes all its money from Law as a Project scale work to cannibalize some of that work through tech that turns the Project into just a series of programs, processes, and expert people.

Traditional Lawyer vs Legal Entrepreneur

Who will win the legal innovation field? Certainly, those who approach a given transaction or relationship holistically, rather than matter-by-matter or sliver-by-sliver.

It is the difference between a traditional lawyer (matter-by-matter) and the Legal Entrepreneur (sustainable solution to a large group for a given transaction or relationship).

The need for a holistic solution is why I think public, permissionless blockchains are an important part of the puzzle. You don’t want your justice system to become a walled garden.

Mr. Chamberlain says the College will also research whether technology can improve the way people access justice.

“Everyone talks about access to justice, but this is about scaling justice, and can you mass-produce it,” he says.

“We’re looking at that, and that’s why it’s academic research, not corporate research and development.

“It might be that the current model of accessing justice is the best there is. We don’t know yet.”

Scaling Justice vs improving Access to Justice

Q: Access to justice is a frequent topic. Do you have some off-the-bat examples of how said technology can help with the ATJ issues?

SC: I don’t like the term “access to justice”. To me, it has a social justice warrior and meaningless virtue signaling overtones.

My experience, from over 25 years of legal practice, was that almost nobody got proper access to justice and that was particularly true of those in the middle, rather than those at the rich or poor ends of the spectrum.

To me, the problem is to scale justice. The whole system must be more accessible to everyone.

We must change the overall climate, not spend millions trying to fix the daily weather for people in a particular suburb.

Mr. Chamberlain plans to create two postgraduate Masters courses in the first semester of 2020, subject to approval, that examine the technology proposals in theory and practice.

Q: Why should lawyers care about blockchain, DLT, and smart contracts in the first place?

I think they should because these are the tools from which you can build a better justice platform. Without these tools, justice will struggle to scale.

Not all lawyers need to know or care about these technologies. But if you are interested in building a better world – or avoiding the dystopian worlds that omniscient tech makes agonizingly possible – then a working knowledge of these technologies is essential, in my view.

Solving real-world problems with blockchain

Q: What about some of the practical issues? E.g. judgement / debt collection / assignment / title transfer? Can DLT streamline any of those?

SC: All these use-cases are interesting. Let’s take debt collection as an example. The problem isn’t collecting the debt, but the whole relationship underpinning the loan.

The whole justice platform for documenting, managing, and enforcing a debt is often unaffordable in comparison to the value of the debt. There are problems establishing the debt exists, that it hasn’t been paid, and getting an order that it should be paid and through what installment regime.

And that is just the process of getting a judgment that the debt is owed and should be paid.

The process of enforcing the judgment – of actually making the delinquent debtor suffer the consequences of not paying – is even more labyrinthine, uncertain and unsatisfactory. It involves more court orders, sheriffs, bailiffs, garnishees, sequestrations and bankruptcy applications. All for the debt to remain unpaid...

A holistic approach to this problem would begin with some kind of smart contract to automate the loan. That same platform would provide some kind of mechanism for resolving edge-case disputes not covered by the smart contract.

Enforcing your rights automatically

It would also automate the process of enforcing rights, such as garnisheeing wages, directly debiting payor bank accounts, and providing a mechanism for the parties to adjust and dispute the quantum of debts.

It might also provide some form of insurance against non-payment/ fraud/misrepresentation, or perhaps a tokenized marketplace for the debts to be sold. Debt collection companies and liquidation firms might highly value the capacity to purchase such debts, particularly since their creation would be so standardized and so easily proved.

(investigating, scoping, and proposing such a solution, including an analysis of any regulatory roadblocks or deal-breakers, would be a suitable white paper for a student in our course)

Final thoughts and next milestones

Q: Some authors are quite skeptical re potential and practical impact of blockchain. What are your thoughts on that?

SC: Lots of people are skeptical. I disagree (but my research might prove me wrong).

The failure of project-based law firms to meaningfully implement technology is neither a surprise nor damnation (of the firms or legal tech).

I think the point is blockchain is not a solution in and of itself. It is a solution as part of a platform.

One law firm can’t innovate how everyone else does litigation. That means the solution lies outside particular firms and needs to include entrepreneurs, courts, and government.

At its heart, the law is not complex. It defines who exists (identity/legal personality) what exists (assets), rights and obligations between those things (relationships) and provides dispute resolution mechanisms.

At present, the law is cumbersome because it involves people reading and agreeing upon the meaning of written words.

It seems to me perfectly possible, and desirable, for large chunks of the law to run automatically. Not all the law, but enough of it for the system to scale and better meet the demands of a globally connected, digital economy running 24/7/365 at the speed of electrons.

Blockchain and Legal Tech courses

Q: What are your plans moving forward?

SC: We are planning two courses. The first will be an overview of the tech and some of the interesting legal issues arising from them, individually and in combination. The main outcome of this course will be a major research paper on an issue of the student’s choice.

The second course will build upon the knowledge of the first. However, the main outcome will be a white paper proposing a sustainable, holistic solution to a systemic legal problem using some or all of the Lex Automagica tech-stack in concert.

From the two courses, students will gain a deep insight into emerging technology and demonstrate the capacity to completely innovate legal relationships using that technology.

Q: Finally, when can we expect the first results from your research?

SC: This year. We are working on four projects already. Life is very busy and tremendously exciting.

Ivan Rasic holds the Transnational Trade Law and Finance LLM, a program by Universidad de Deusto (Bilbao, ES), Universiteit van Tilburg (Tilburg, NL), and Goethe Universität (Frankfurt, DE). After his work in law firms and inhouse, he started a legal tech company.

Nowadays, Ivan leads STP Informationstechnologie GmbH's Sofia RnD center with project/development management, culture, strategy, and special project initiatives.

Ivan is an Ambassador at European Legal Tech Association (ELTA). He closely follows and writes on future of law, legal tech, ALSPs, and new ways of delivering legal services.

Scott Chamberlain is a Senior Lecturer at Australian National University (ANU) College of Law, where he teaches courses like Legal Entrepreneur, The Future of Legal Practice, and Blockchain & Legal Innovation.

Scott has, driven by his vision of Lex Automagica, received UBRI funding to research Blockchain and DLT's impact on our civilization.